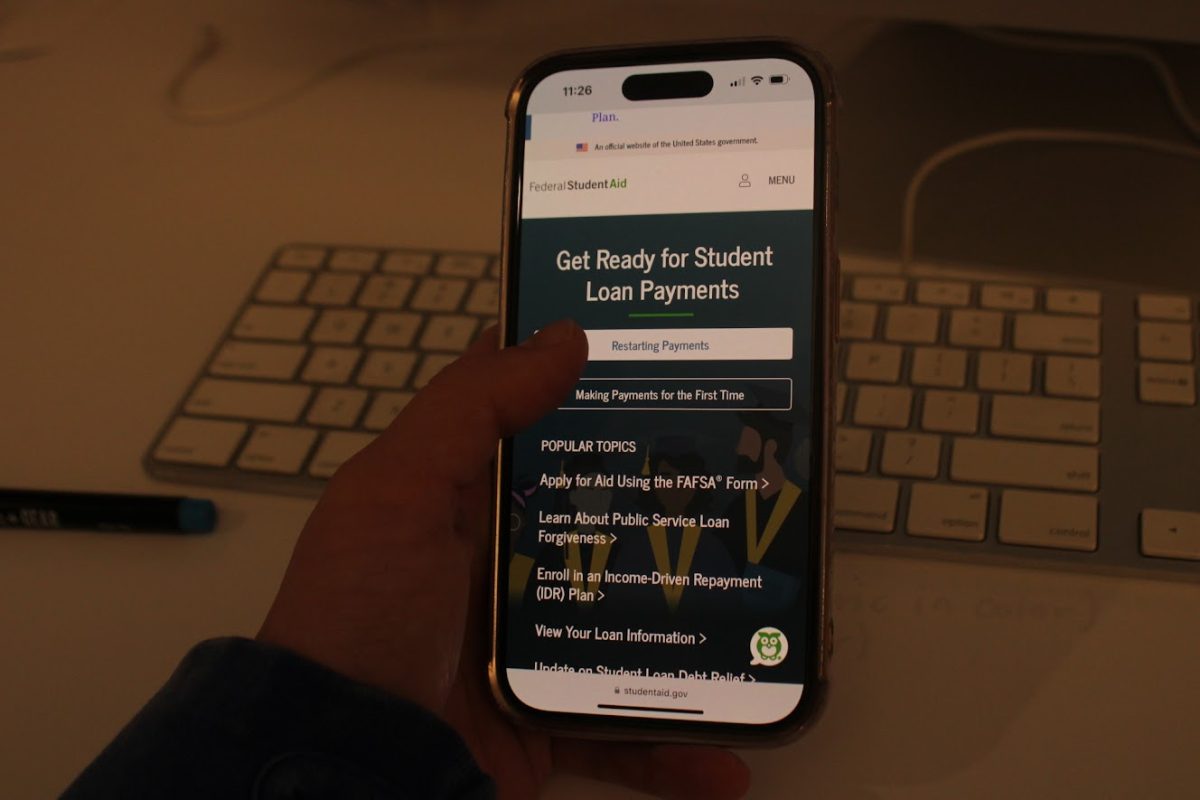

Federal student loans and interest were frozen from March 2020 to Sept. 2023 because of the COVID-19 pandemic and currently, nearly 28 million people were brought back into repayment this fall. Many student loan borrowers waited hours on hold with their loan servicer to find out how much they owe, what day their first payment is due or to make an early payment to avoid paying interest.

About 305,000 people initially received student loan bills with the wrong amount. Additionally, loan servicer Missouri Higher Education Loan Authority (MOHELA), sent late billing statements to 2.5 million borrowers. As a result, 800,000 of those borrowers made late payments.

“As a student at New Haven who’s financially independent from their parents, it’s already a financial hardship to take out loans in your own name and build your own credit as an independent person. So, having it all get messed up could hurt me in the future and obviously is hurting people right now,” said sophomore Brynna Courneen.

The Department of Education (DOE) penalized MOHELA by withholding $7.2 million of its payment. The DOE has enforced that borrowers who have been caught in the mistakes will be put into forbearance, which is a period when payments are not required and interest is frozen until the mistakes are resolved.

Borrowers put in forbearance will have a 12-month period where they will not pay and interest will not be raised, which is also known as the on-ramp period. It will extend from Oct. 2023 to Sept. 2024.

Four United States senators have raised concerns about how the DOE is handling the return of student loan payments. This is because the on-ramp period given to borrowers could cause “unanticipated consequences” with their credit scores, according to a letter written by the senators to the DOE.

Sens. Elizabeth Warren (D-Mass.), Richard Blumenthal (D-Conn.), Chris Van Hollen (D-Md.) and Bernie Sanders (I-Vt.) signed and sent the letter, which said, in part: “The chaotic resumption of federal student loan payments has raised questions about the extent of errors and the measures being taken by the Department to address these concerns and provide assistance to affected borrowers.”

What usually happens when a student loan payment is missed is the loan will become delinquent, causing loan servicers to report the delinquency to the three national credit bureaus if a payment is not made within 90 days, which can damage a person’s credit score.

“I was only able to buy my car because I had a good credit score already and so I was only able to have my dad cosign it due to my own credit score. In the future, having a good credit score on a car loan and building your credit will help me to be able to buy a house or other big purchases in the future,” said Courneen.

During the on-ramp period, the DOE “prevents the worst consequences of missed, late, or partial payments, including negative credit reporting for delinquent payments for twelve months,” according to the DOE website. Also, missed payments will not be considered delinquent during an on-ramp period and the missed payments will not be put into forbearance until the 90 days are up, according to the Federal Student Loan website.

This means that they are not reporting to loan services but it does “not control how credit scoring companies factor in missed or delayed payments,” the DOE said on their website.

The senators’ letter also said, “This retroactive approach could also unintentionally depress borrowers’ credit scores during those 90 days before the forbearance is applied if a servicer inaccurately reports a borrower’s information. ED [Department of Education] should explore whether placing accounts in forbearance on the 30th or 60th day after a missed payment — rather than the 90th day.”

Another New Haven student, Carina Ramirez said on the issue, “Student loans are already a drag and now that it has the potential to affect my credit or another student’s credit, makes me lose faith in the whole system.”

At the end of the senators’ letter to the DOE they “request answers” to the questions raised about the “bureaucratic complexities and insufficient oversight” by the DOE “no later than December 15, 2023.”

The DOE said in a statement to CNN that they “received the letter and will review it.”

Concern arises around the return of student loan payments

Erin Smith, Politics Editor

December 11, 2023

The return of federal student loan payments, West Haven, Dec. 10, 2023.

0

More to Discover

About the Contributor

Charlotte Bassett, Photography Editor

Charlotte is an MBA student this year after finishing her undergraduate degree in accounting in the spring of 2024. This is her fourth year taking photos for the newspaper and second year as Photography Editor. In addition to taking pictures she is also on the Women’s Basketball team at UNH, and she is originally from Glastonbury, CT. Taking photos has always been something she’s loved, especially down at Old Lyme where she would spend her summers. The Charger Bulletin has been really fun for her so far and the writers always have good stories, which call for good images!